Massive digital transformation has taken the entire country on its stride. It is not only for the internal transparency and better operation and management but also for doing business with the external world aligning the multi-national companies. Indian ICT distribution market known for its stock and sell strategy is also going through the transformation rout.

According to IDC, India’s IT and Services Market will be valued at US$14.3 billion by the end of 2020. This is enabling massive digital transformation in the market. It is the IT distribution fraternity which is the lynchpin behind the digital transformation by supplying right IT and services products. However, for a long time the distribution market was not able to align with the growth pattern of the market. Finally, for last couple of years the distribution business has understood the DNA of the industry. Distributors are evolving across multiple fronts, whether Product Strategy – how they align with different innovative product vendors which are disruptive in nature and relevant for the market evolution, whether HR Strategy – how they bring in IT workers with requisite skillsets and attitude, whether it is Marketing Strategy – how they market it to the partners or co-creating joint marketing strategy with the partners, whether it is Pre- sales & Sales strategy, how they handhold the partners and create POC with the partners for the customers and even realigning with new-age partner ecosystem and planning customer experience and support for the OEMs and partners.

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“We will focus on products where our margins are better, and the capital investment is less. We have already started this shift in our product lines and service offerings quite successfully.”

“We will focus on products where our margins are better, and the capital investment is less. We have already started this shift in our product lines and service offerings quite successfully.”

Sanjiv Krishen,

Chairman,

Iris Computers Ltd

[/quote]

Now, Distributors are mostly focused on improving their profitability, expanding their margins, and out thinking the competition. On this, Harish Laddha, Executive Director, Head of Sales, Ingram Micro, says,” The IT distribution industry has undergone a significant transformation in the past decade owing to changing market dynamics. As SMBs and enterprises rapidly embrace digital transformation and technologies like HCI, SD-WAN, Cloud, IoT & AI, distributors have had to adopt a solution-based approach by integrating a range of value-added services on top of the products they offer. At Ingram Micro we also focus a lot of our efforts around training channel partners on the latest technologies and solutions. This helps resellers recommend solutions that help customers increase operational efficiency and enhance profitability.”

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“Our ability to expedite response times, enhances vendors’ reach, and creates value-added solutions that complement vendor offerings all help to enhance brand value.”

“Our ability to expedite response times, enhances vendors’ reach, and creates value-added solutions that complement vendor offerings all help to enhance brand value.”

Sundaresan K,

VP and Country General Manager,

Tech Data

[/quote]

Sanjiv Krishen, Chairman, Iris Computers Ltd., said, “The IT distribution market has grown nearly 300% in the last 10 years. Out of the total market size of Rs.100,000 crore, distribution business accounts for Rs.70,000 crore. However, the business categories are shifting; while some of the IT categories including PCs and notebooks are declining and categories including cloud, smart phones and tablets are growing.”

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“We are confident of strengthening our position as the leading distributor and increasing our market share in 2020.”

“We are confident of strengthening our position as the leading distributor and increasing our market share in 2020.”

Harish Laddha,

Executive Director,

Head of Sales,

Ingram Micro

[/quote]

Mohan Kumar TL, Director, TechKnowLogic Consultants India Private Limited, says, “Distribution business has for sure come a long way from the last decade with our country embracing digitization in day-to-day activities. In 2018 Over 12.3 billion mobile applications were downloaded in India a lone. The digital payments’ transaction value is estimated to grow at a CAGR of 20.2% from approximately USD 64.8 billion in 2019 to USD 135.2 billion in 2023. Around 47.5 billion national e-transactions have been recorded in 2019, till November. Technology is at its best right now and the evolution is happening at a consistent rate. We have come a long way from being in the distributor business of hardware to solutions like Network Monitoring, SIEM, SOAR, Cloud Security etc.”

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“It is our unique go-to market that has helped us crack a lot of successes in a short span of time. Our go to market approach is use case based “swim lane approach”.

“It is our unique go-to market that has helped us crack a lot of successes in a short span of time. Our go to market approach is use case based “swim lane approach”.

Prashanth G J,

CEO,

TechnoBind

[/quote]

However, new technologies, changing market dynamics, and increasingly demanding customers have fundamentally reshaped the way today’s distributors do business. There has been a significant expansion in distribution channels in India during the past few years. Most Indian distributors use a two-tier selling and distribution structure that has evolved over the years. Anil Bhavnani, Founder & CEO, Rankcomputers, which is the India Distributor for DATALOCKER, say,” Technology is at its best right now and the evolution is happening at a consistent rate. Distributors have come a long way from being in the distributor business of hardware to solutions like Network Monitoring, SIEM, SOAR, Cloud Security etc.”

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“Today, Satcom bills to more than 500 partners in a calendar year but by 2020, the company expects to grow the number by at least 25% and take its revenue to Rs.200 crore in next one year.”

“Today, Satcom bills to more than 500 partners in a calendar year but by 2020, the company expects to grow the number by at least 25% and take its revenue to Rs.200 crore in next one year.”

Vinod Kumar,

MD,

Satcom Infotech Pvt Ltd.

[/quote]

Even Distributors are now managing customers differently. For the distributors’ demands for digital capabilities have created a lot of pressure, even though they are adopting these technologies such as cloud computing, AI & ML and, Analytics and they are helping distributors achieve higher margins by operating in a more profitable way. And strategic and technological innovations have created new opportunities for growth, collaboration, and transformation. Rajesh Goenka, Director of Sales Marketing, RP Tech says, “Wearable, Artificial Intelligence, Deep Learning and Networking are the technologies that will drive our business in the next 3 years”.

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“We have come a long way from being in the distributor business of hardware to solutions like Network Monitoring, SIEM, SOAR, Cloud Security etc.”

“We have come a long way from being in the distributor business of hardware to solutions like Network Monitoring, SIEM, SOAR, Cloud Security etc.”

Mohan Kumar TL,

Director,

TechKnowLogic Consultants India Private Limited

[/quote]

In a highly competitive market just selling products is not enough; customers are looking for a total package now, a combination of products and services. Therefore, Distributors need to give their customers a reason to come back – wider and more customized services. The distribution industry is changing its ways from traditional distribution and taking a new direction towards Value Added Distribution. Vinod Kumar, MD, Satcom Infotech Pvt. Ltd. says, “It has evolved and grown from being a box or hardware distribution to a solution offering with mix of software as well as hardware and software combinations”

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“The IT distribution business has gone through a massive transition in the last decade. A major transformation has happened from box selling to PC selling and now solution selling. Today, the selling price is not only the deciding factor of profitability and growth. Along with the price, credit, inventory management, pre-sales & post-sales support also critical aspects of long term and sustainable growth.”

“The IT distribution business has gone through a massive transition in the last decade. A major transformation has happened from box selling to PC selling and now solution selling. Today, the selling price is not only the deciding factor of profitability and growth. Along with the price, credit, inventory management, pre-sales & post-sales support also critical aspects of long term and sustainable growth.”

Rajesh Goenka,

Director,

Sales & Marketing, RP tech India

[/quote]

Therefore, value business or value distribution is the new mantras of new age distribution, and the distributors are vigorously trying to implement positive strategies for taking it forward.

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“We are expecting to appoint distributors in territory we do not represent at the moment and also appoint additional five partners for our SMB and enterprise solutions.”

“We are expecting to appoint distributors in territory we do not represent at the moment and also appoint additional five partners for our SMB and enterprise solutions.”

Zakir Hussain Rangwala,

Sales Marketing Director,

BD Software Distribution Pvt. ltd.

[/quote]

Ingram Micro is currently working with more than 15,000 channel partners across the country. As per Harish of Ingram Micro “Industry trends are key drivers for any business, and we have spent a considerable amount of time evaluating these trends to make the right investments and serve our partners and customers better. Our key focus areas include Cloud, Cybersecurity, Advanced Solutions and IoT. We have also invested in building our capabilities around IT asset disposition and e-commerce. Additionally, partner enablement continues to be a key priority for Ingram Micro and we have rolled out several initiatives including flexible financing options, consulting services, sales training and partner incentive programs.” He added, “We are confident of maintaining our position as the leading distributor with a market share of over 31%”

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“Our measure is not how many partners we work with but how many solutions we have been able to see to existing customer and how many new customers we are able to win through our unique solutions. We address 700+ partners across global, national and regional profiles.”

“Our measure is not how many partners we work with but how many solutions we have been able to see to existing customer and how many new customers we are able to win through our unique solutions. We address 700+ partners across global, national and regional profiles.”

Sriram Srinivasan,

Co-founder, CSO

iValue Infosolution

[/quote]

Rajesh Goenka, Director, Sales & Marketing, RP tech India, said: “The IT distribution business has gone through a massive transition in the last decade. A major transformation has happened from box selling to PC selling and now solution selling. Today, the selling price is not only the deciding factor of profitability and growth. Along with the price, credit, inventory management, pre-sales & post-sales support also critical aspects of long term and sustainable growth.”

[quote font=”tahoma” font_size=”13″ font_style=”italic” color=”#262626″ bgcolor=”#f9f9f9″]

“We are on the lookout for partners who understand the potential and market of our unique offerings: Secure Military Grade Encrypted Hard Drives and Pen Drives and their remote management solution from DataLocker USA.”

“We are on the lookout for partners who understand the potential and market of our unique offerings: Secure Military Grade Encrypted Hard Drives and Pen Drives and their remote management solution from DataLocker USA.”

Anil Bhavnani,

Founder & CEO,

Rankcomputers

[/quote]

iValue has come a long way during the last 10 years. Sriram Srinivasan Co-founder, CSO, iValue Infosolution, added: “We continue to evolve to meet emerging needs of our customers and partners. We recently categorized our offerings in line with Digital Transformation initiatives of customers. We continue to add compelling and complementing solutions around Data, Network, and Application management space to help partner enhance their wallet share with each of their customers. Our solution category under Digital Transformation needs of Enterprise customer include Hybrid cloud management; Availability and Performance management; NextGen security; Consolidation and Automation; Security analytics along with Pre and Post sales Services for these offerings.”

iValue’s focus is around Transformation, Protection and Management of “Digital Assets” which covers Data, Network, and Application (Actual DNA of every business) protection, optimization, and management solutions and associated services for enterprise customers.

Sundaresan K, VP and Country General Manager, Tech Data, says, “The days of distributors simply moving boxes is over. Today OEM’s expect much more from distributors than merely distributing their products. At Tech Data, we see our role evolving to be more of an orchestrator or solutions, facilitating value-driven dynamic interactions across an ecosystem of vendors, resellers, ISVs, integrators, service providers and customers with the ability to gain greater access to markets, and scale and solutions quickly.”

“Our ability to expedite response times, enhance vendors’ reach, and create value-added solutions that complement vendor offerings all help to enhance brand value. Distributors today also have larger role to play in marketing focused on driving enhanced results for partners and vendors. This encompasses creating innovative programs and services focused on high growth markets that help partners grow their businesses and driving demand creation and lead generation initiatives which enable partners to unlock new revenue opportunities,” he added.

As its renewed strategy, Satcom has evolved into a very highly focused VAD in the cyber security space. Vinod maintains, “We understand technology and try to bring in futuristic offerings which our partners in India can offer to their customers. We are present in eight cities across PAN India and offer enablement, training and remote support to partners. We assist partners in doing proof of concept to their prospects, provide demo equipment and on time delivery to our partners.”

Their plan is to expand slowly by adding at least two new product lines this year again focusing either on deception technology, NMS or SIEM. As a brand, Satcom is trying to keep itself updated by automating all its systems and procedures and having a SOP for each aspect of its operation.

Overall distribution has expanded. Iris as a distribution company is growing 30% per year. As per Zakir Hussain Rangwala, Sales Marketing Director, BD Software Distribution Pvt. ltd., BD Software started with one product but today the company eight good solid products & solutions to offer to the SMBs & enterprises. He added, “We will add two more products during the year to make it total of ten product offerings in the market.”

BD Software has more than 200 partners doing MSB & enterprise business across India. BD Software has also distributors for consumer business and under them are partners in their territories. Zakir adds, “We are expecting to appoint distributors in various territories where we do not represent at the moment and also appoint additional five partners for our SMB and enterprise solutions.”

Rankcomputers has just recently moved to a channel only model for its distribution business for Secure Military Grade Encrypted Pen Drives & Hard Drives and their remote management solution from DataLocker USA. In the last 3 months, the company has over 11 active partners promoting and selling DataLOcker products and the more are joining us. As per Anil the company expects to have over 30 active partners PAN India by the end of this year.

TechnoBind works with over 600 partners across the country. While they have Global SIs like Infosys, TCS on one side, the other side they also have engaged with the National and Regional SIs who have a country-based presence in India. Along with this, the company also has a very large SMB Partner engagement across the country.

With so many vendor tie-ups and geographical presence, Technobind has recorded a stellar growth of 60 percent YoY last FY. As per Prashanth, “It is our unique go-to market that has helped us crack a lot of successes in a short span of time. Our go to market approach is use case based “swim lane approach.”

Tech Data’s strategic focus is based on driving growth and enabling our channel partners to move to higher value. The four pillars of this strategy are Investing in next-generation technologies: hybrid cloud, data (analytics, IoT), security and services, Strengthening our end-to-end portfolio: enhancing our partner, vendor and solutions portfolio, and consumption models, Transforming Tech Data digitally: Through process redesign, automation, advanced analytics and user interfaces and Optimizing our global footprint: driving services, support, and business optimization Our portfolio contains the most comprehensive collection of data center and next-generation technology solutions to meet every aspect of our partners’ needs, as well as our Specialized Solutions businesses.

Plan for 2020 and beyond

Data is the traction for every business, irrespective of their sizes. Most of the organizations treat data as a vital corporate asset. With the advent of globalization and internet age, we will see that in Data will remain the core focus. All the technologies we focus will revolve around data to leverage the challenges this data growth is throwing up. The IT market will be driven by data related solutions from storing, securing, and utilizing for informed decision making to predictive analytics.

Technologies like Artificial Intelligence, Machine Learning, Cloud, Blockchain and many more became the brainstorming topics of discussion for boardrooms last year. Whereas, 5G steal the show by being on the top the whole year. These technologies will continue to impact businesses in 2020 and will certainly become integral parts of companies’ plans to become future ready.

TechnoBind has a strategic plan to look forward for both linear and non-linear growth this year.

Prashanth adds, “We already have a strong hold in catering the products that ensure data management, storage, protection and security. Recently, we have associated with Beyond Trust to cater its Privileged Access Management (PAM) portfolio across India and Bangladesh.

Ingram Micro will continue to have specialized business units to effectively cater to the needs of specific customer segments. Harish Of Ingram Micro maintained, “We are constantly vetting our catalog and adding world-class products and solutions to help our partners to grow their businesses and address the changing technology needs of modern consumers as well as enterprises. Our solution offering is one of the broadest in the industry, and includes IT Hardware, Software, Cloud and Mobility products from more than 200 leading vendors.”

However, Ingram Micro is hopeful that for the year, technologies including Cloud (SaaS & IaaS), IoT, Security products & services and HCI & datacenter modernization are going to drive its revenue.

Tech Data strategy is to move to higher value through investing, strengthening, transforming and optimizing its business and enabling its channel partners to do the same. Sundaresan says, “One key area I’d like to highlight now is digital transformation which is creating immense opportunities for businesses today. Some of the key technologies include big data and analytics, Artificial Intelligence, the IOT and next-generation security. Businesses in India are leading the charge by embracing these technologies to transform their businesses, becoming more efficient and agile and driving high-growth opportunities.”

Recognizing these market trends and opportunities will be the priority for Tech Data. The company will keep reviewing and expanding upon its portfolio in strategic areas, ensuring providing the most comprehensive solutions for its partners. Cloud, Analytics, IoT and Security are some of the key areas Tech Data is investing in to capitalize on the immense opportunities that lie ahead.

For BD Software plans for 2020 are very simple as they will continue with their existing eight brands but at the same time, they will look to get in couple of more good brands which can be distributed via its current channel partners. These new technologies would revolve around Endpoint Security Solutions, DLP, Backup and OCR/ICR. By doing this the company expects to double its growth this year compared to last year.

Iris today is distributing products portfolio around Desktops, Notebooks, Servers, Storage Networking, Power conditioning, Solar, Smart phones, Tablets and Consumer Electronic goods. These products are helping Iris growth till today. “But going forward in 2020, Sanjiv adds, “We will focus on products where our margins are better, and the capital investment is less. We have already started this shift in our product lines and service offerings quite successfully.” With this strategy, Iris is confident to growth its revenue by 30% this year to close it at Rs.1800 crore.

iValue’s top customer verticals have been BFSI, ITeS, Telecom, Manufacturing, Pharma, and Hospitality. Sriram adds, “We will continue to add solution and service offerings for these segments. We also have plans to add capability through inorganic way to enhance our relevance to both Customer and Partners.” During the last 5 years, iValue continues to grow at 4+ times market growth. The company intends to continue this trend even on a higher base. Market trends such as Privacy, Compliance, Automation driven by Analytics, AI and ML will drive revenue streams. Cyber security was the highest challenge for most leaders at Davos.

Sriram maintains, “We continue to focus on offerings that help customer stay ahead of these needs in the coming years. Our approach in the market is to consultatively understand and address customers business and IT needs around DNA offerings with a medium to long-term perspective.”

Similarly, Rankcomputers plan to increase its ACTIVE partners from the current level of 11 to 30 ACTIVE partners by the end of the year. Anil adds, “We are on the lookout for partners who understand the potential and market of our unique offerings: Secure Military Grade Encrypted Hard Drives and Pen Drives and their remote management solution from DataLocker USA.” The company expects that it will help them to enhance their revenue by by over 150% to 200% this year.

RP Tech India will consolidate its existing business and improve business hygiene in 2020. At the same time the company expects that new technologies like Wearable, Artificial Intelligence, Deep Learning and Networking will its business in the next three years, which will enable them to grow at double-digit against market forecast of single-digit growth.

Satcom today is billing to more than 500 partners in a calendar year but in 2020 this will grow by at least 25%. The company will add at least two new product lines this year focusing either on deception technology, NMS or SIEM. Vinod says, “As a brand we are trying to keep ourselves updated by automating all our systems and procedures and having a SOP for each aspect of our operation. We plan to reach 200 crores in the next one year.

Finally…

Distribution business is going to be very interesting and challenging in next twelve to sixteen months because computing is going to change drastically. From on-prem to cloud and hybrid, there will be a movement one side on the other side, new applications, security challenges, storage and back up integration would demand a multi-point challenge for the market. The old products and solutions are going to be refreshed very soon and most likely there will be new age solutions around 5G, Edge Computing and AI- based computing, which would require a different mindset and skillset. But surely it is very exciting time ahead.

Ingram Micro

Revenue from 2017-2019 (in crores)

Annual turnover has exceeded $3.5 billion every year

Employee strength forecast for 2020.

Over 2000 associates

Location presence growth in 2020.

Have presence in more than 33 cities across India

Ingram Micro product portfolio (Hardware and Software)

Have a portfolio of over 250 products with 200+ hardware and 50+ software & service offerings.

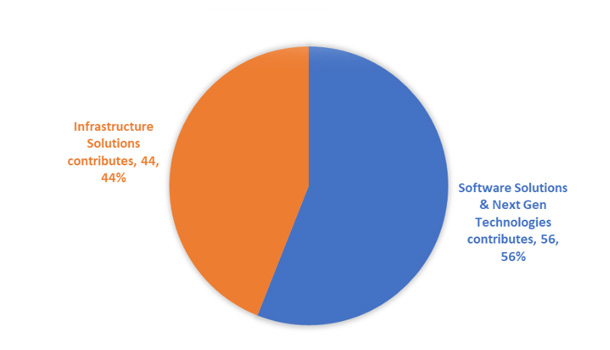

Breakup of Technologies that Ingram Micro is into Percentages by portfolio coverage, not revenue.

Technology solution that Ingram will be investing in 2020

In 2020 its key area of focus will be expanding its solution portfolio and capabilities around Cloud and IoT.

HCL Info Systems fact sheet

Revenue of last three years – 2017-2019

FY 18 Rs. 4340 Crore

FY 18 Rs. 3,612 Crore

FY 17 Rs. 3,225 Crore.

Employee strength as of now and forecast for 2020.

1207

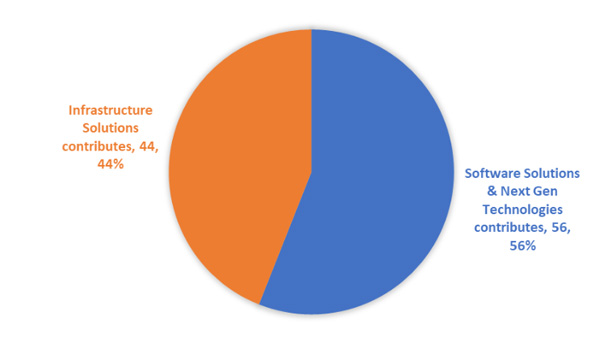

Give a breakup of your product portfolio percentage wise (Hardware and Software)

- DATA CENTER

- NETWORK & SECURITY

- OFFICE AUTOMATION

- END USER COMPUTING

- DIGITAL CONVERGENCE

- ENTERPRISE SOFTWARE

- HCL SERVICES

- ENTERPRISE SOLUTIONS

- BYOD: HCL’s comprehensive BYOD Solution includes

Tech Data

Revenue of last three years – 2017-2019

In fiscal year 2019 Tech Data’s worldwide sales grew 11 percent to more than $37 billion.

In Asia Pacific, net sales were $1.2 billion, an increase of 14 percent compared to fiscal year 2018.

▪ Fiscal 2019 – Sales USD 37.2 Billion globally

▪ Fiscal 2018 – Sales USD 36.8 Billion globally

▪ Fiscal 2017 – Sales USD 26.2 Billion globally

• Employee strength as of now and forecast for 2020.

14,000+ employees worldwide – forecast for 2020

• Location presence as of now and growth in 2020.

100+ countries served

Give a breakup of your product portfolio percentage-wise (Hardware and Software)

Give the breakup of technologies that you are into percentage-wise. Eg: Mobility, storage, Computing, Security, networking, etc. – require percentage data

What are your major contributions to the business technology-wise?

Tech Data’s world-class execution, end-to-end offerings and deep expertise enable our partners to meet their customers’ needs today and provide them access to the innovative technologies of tomorrow.

Tech Data has proven experience and a vast array of solutions across data center and next-generation technologies including:

- Data Center Solutions: IBM, HPE, Dell Technologies, NetApp, Lenovo, Oracle, VMware, Citrix, Nutanix

- Next Generation Solutions: Microsoft Azure, Checkpoint, Barracuda, Cyberbit, Color Tokens, Cloudera, Automation Anywhere

Our solutions specialist approach empowers partners with the dedicated resources, sales support and technical expertise needed to transform their business while driving long-term success for themselves and their customers.

What is your forecast for 2020, if there is any change in terms of technology contribution to overall revenue?

- Is there any technology solution that you are looking at investing in 2020?

We continue to invest in next-generation technologies: hybrid cloud, data analytics, IoT, security and services.

Iris Computers

Please provide these data for our reference:

Revenue of last three years – 2017-2019

- 2017-18 Rs 1021 cr

2018-19 Rs 1310 cr

2019-20 Rs 1600 cr

Employee strength as of now and forecast for 2020.

Now 280 employees. Next year 330.

Location presence as of now and growth in 2020.

Now 27 locations. Next year 32.

Give a breakup of your product portfolio percentage wise (Hardware and Software)

What are your major contributions to the business technology wise?

We are supporting new age start up partners who are focusing on Artificial Intelligence, cloud and mobility.

What is your forecast for 2020, if there is any change in terms of technology contribution to overall revenue?

These new age applications should contribute 30% in our revenues during 2020.

Is there any technology solution that you are looking at investing in 2020?

Our model remains partner oriented. We will support partners who are offering new technologies to customers as our focus is to help our partners grow successfully.

RP Tech India

Revenue of last three years – 2017-2019

NA

Employee strength as of now and forecast for 2020.

900+ employees

Location presence as of now and growth in 2020

We have a direct presence in 50 locations through branches, service centers and warehouse.

Is there any technology solution that you are looking at investing in 2020?

Upgrade SAP operations in 2020.

Rankcomputers

Revenue of last three years – 2017-2019

NA

Employee strength as of now and forecast for 2020.

Increase by 30%

Location presence as of now and growth in 2020.

Mumbai, Pune, Delhi, Bangalore

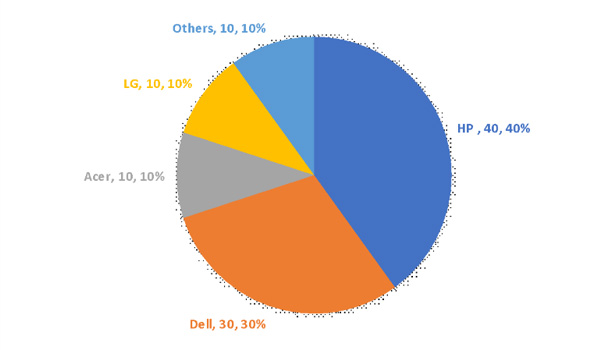

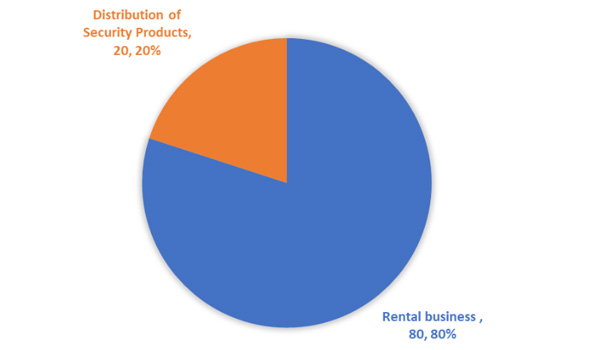

Give a breakup of your product portfolio percentagewise (Hardware and Software)

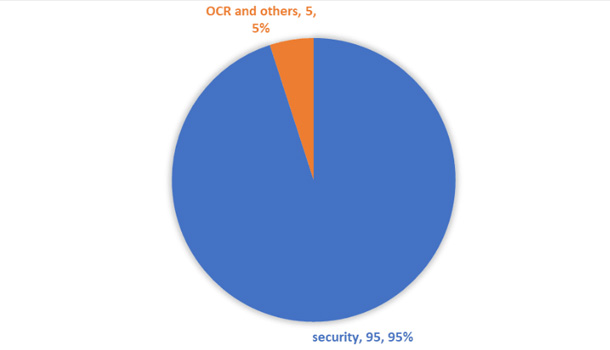

Give the breakup of technologies that you are into percentagewise. Eg: Mobility, storage, Computing, Security, networking, etc.

In our IT rental business – almost all new IT products & technologies. In the distribution business 100% Cyber Security.

What are your major contributions to the business technology-wise?

Mobile Endpoint Security which is 100% Secure with Military Grade Technology.

What is your forecast for 2020, if there is any change in terms of technology contribution to overall revenue?

Expecting to have increased revenue share from Cybersecurity.

Is there any technology solution that you are looking at investing in 2020?

Cyber Security

BD Software

Revenue of last three years from 2017-2019

Employee strength as of now and forecast for 2020. 40 as of today. 60 by end of the year 2020. Offices in Mumbai & Kolkata.

Give a breakup of your product portfolio percentagewise (Hardware and Software)

100% software

Give the breakup of technologies that you are into percentagewise. Eg: Mobility, storage, Computing, Security, networking, etc.

What is your forecast for 2020, if there is any change in terms of technology contribution to overall revenue?

Is there any technology solution that you are looking at investing in 2020?

SATCOM

Revenue from 2017-2019 (in crores)

Rs.40 to Rs.72 (Growing at 35%)

Employee strength forecast for 2020.

35 and 42

Location presence growth in 2020.

8 locations now … will add 2 more locations

Satcom product portfolio (Hardware and Software)

It is mostly into software